I have come across this great article from Harvard Extension school fellow explaining the real estate cycle in great detail with past numbers.

Read the full article at his website.

Let me quickly share snippet about his 3 indicators to watch out for the next down turn,

The First Indicator of Trouble

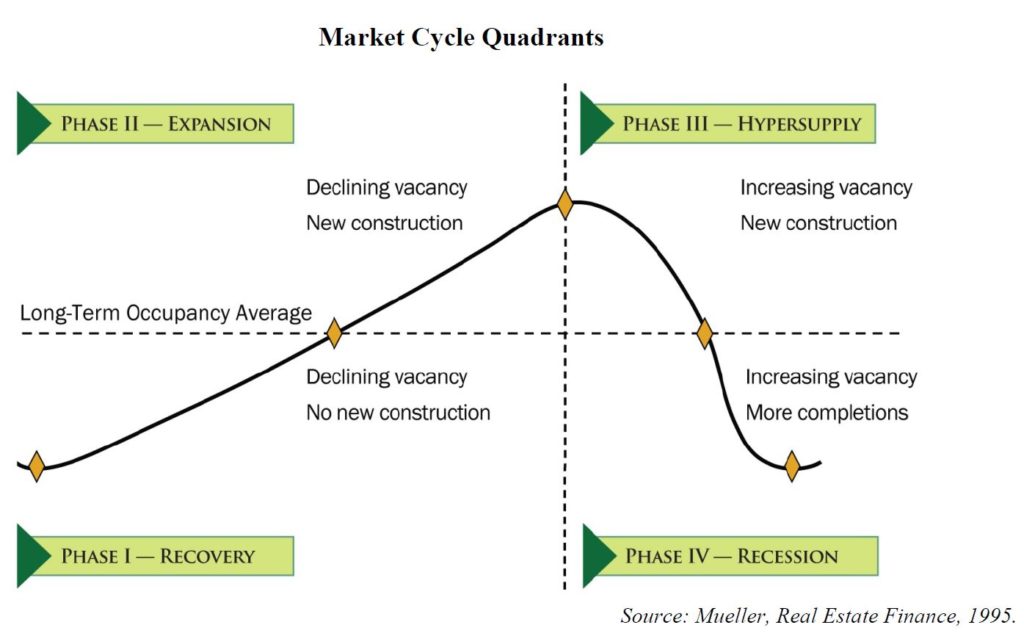

The delineation point between expansion and market hyper supply is marked by the first indicator of trouble in the real estate cycle: an increase in unsold inventory/vacancy.

The Second Indicator of Trouble

The transition from hyper supply to recession is marked by the second indicator of trouble in the cycle: occupancy falls below the long-term average.

New construction stops, but projects started in the hyper-supply phase continue to be delivered. The addition of surplus inventory leads to lower occupancy and lower rents, which significantly reduces revenue for landowners.

The Third Indicator of Trouble

Finally, investors must watch for the third indicator of trouble: an increase in interest rates.

The increases in prices throughout the broader economy that accompanied the expansion and hyper-supply phase will, sooner or later, force the Federal Reserve to fight inflation by increasing interest rates.

Posted in

Posted in