Housing affordability improved in the Greater Houston area as mortgage rates declined slightly in the second quarter of 2025, according to the Houston Association of Realtors’ latest Housing and Rental Affordability Report.

HAR’s Housing Affordability Index shows that 39 percent of Houston-area households could purchase a median-priced home in the second quarter of the year, which is improvement from 37 percent during the same time in 2024.

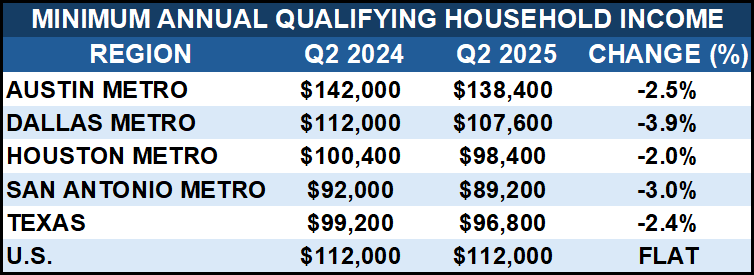

The median home price declined 0.6 percent year-over-year to $349,400. This comes as the average mortgage rate edged down to 6.79 percent from 7.00 percent in the second quarter of last year. The monthly payment on a 30-year fixed-rate mortgage, including principal, taxes and insurance, was $2,460 compared to $2,510 last year. Houston area households needed to make a minimum annual income of $98,400 to buy a typical home, which is down 2.0 percent compared to the same time last year.

Affordability also improved across Texas in the second quarter, with 39 percent of households able to buy a median-priced home compared to 36 percent during the same time in 2024. A minimum annual income of $96,800 was needed to qualify for the purchase of a $344,660 home statewide.

The national median home price edged up by 1.7 percent year-over-year to $429,400, according to new data from the National Association of Realtors. NAR reports that home prices increased in 75 percent of metro areas in the country in the second quarter of 2025. Thirty-four percent of households nationwide could afford the median-priced home.